Ira withdrawal calculator

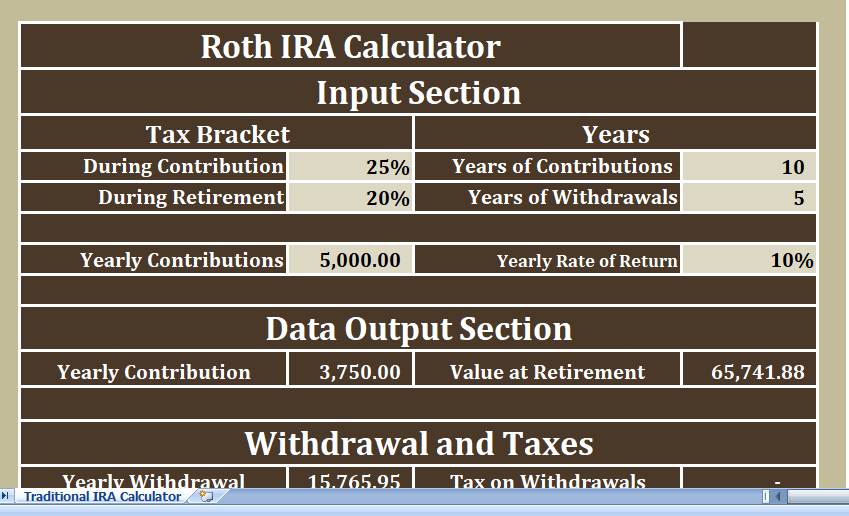

A Roth IRA is a special individual retirement account IRA in which you pay taxes on contributions and then all future withdrawals are tax free. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts.

Ira Future Withdrawal Calculator Forecast Rmds Through Age 113

Roth IRA Distribution Details.

. Calculate your required minimum distributions RMDs The RMD calculator makes it easy to determine your required minimum distribution from a Traditional IRA to avoid penalties and. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your. 25Years until you retire age 40 to age 65.

Keep in mind if your account is less than. Direct contributions can be withdrawn tax-free and penalty-free anytime. The 4 percent rule withdrawal strategy suggests that you should withdraw 4 percent of your investment account balance in your first year of retirement.

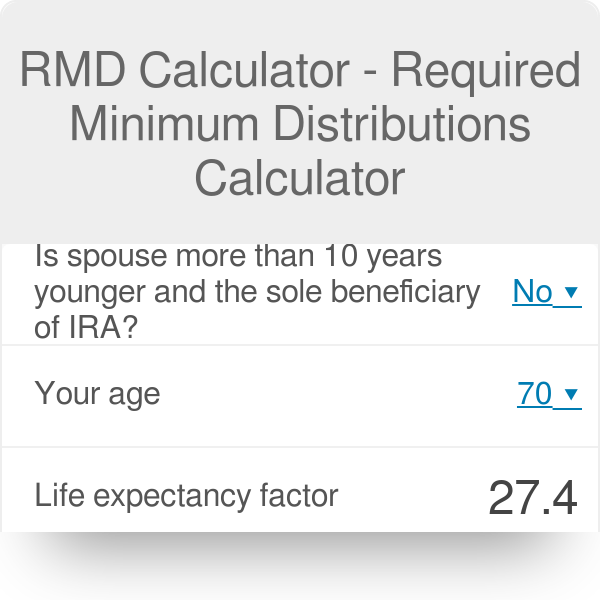

Use this calculator to determine your Required Minimum Distribution RMD. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. Use one of these worksheets to calculate your Required Minimum Distribution from your own IRAs including SEP IRAs and SIMPLE IRAs.

A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year. 2022 Early Retirement Account Withdrawal Tax Penalty Calculator. Your life expectancy factor is taken from the IRS.

Ad Build Your Future With A Firm That Has 85 Years Of Investing Experience. Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. Calculate the required minimum distribution from an inherited IRA.

Calculate How Much it Will Cost You to Cash Out Funds Early From Your IRA or 401-k Retirement Plan. Required Minimum Distribution Calculator. You decide to increase your annual withdrawal by 35 and want the money to last for 35 years with nothing left for heirs after that time.

The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution -. Retirement Withdrawal Calculator Terms and Definitions. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from.

Concerning Roth IRAs five years or older tax-free and penalty-free withdrawal on. Ad Use This Calculator to Determine Your Required Minimum Distribution. Amount You Expected to Withdraw This is the budgeted.

Ad Build Your Future With A Firm That Has 85 Years Of Investing Experience. Compare IRAs get Roth conversion details and estimate Required Minimum Distributions RMDs. With a Roth IRA your withdrawals are tax-free after you turn 59 ½.

Since you took the withdrawal before you reached age 59 12 unless you met. Calculate your earnings and more. Decide how to receive your RMD.

Regardless of your age you will need to file a Form 1040 and show the amount of the IRA withdrawal. Expected Retirement Age This is the age at which you plan to retire. Use our IRA calculators to get the IRA numbers you need.

Savers over age 50 can contribute 7000 per year instead of the 6000 limit. The IRA Withdrawal Calculator which has been updated to conform to the SECURE Act of 2019 will calculate your current minimum required withdrawal and then forecast your future. Learn More About American Funds Objective-Based Approach to Investing.

How is my RMD calculated. Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. You can make a one-time also known as lump-sum withdrawal or a series of withdrawals or schedule automatic withdrawals.

Account balance as of December 31 2021. Ad With a Focus on Client Goals American Funds Takes a Different Approach to Investing. And from then on.

Traditional Vs Roth Ira Calculator

Roth Ira Calculator Excel Template For Free

Roth Ira Calculator Roth Ira Contribution

Retirement Withdrawal Calculator For Excel

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Rmd Calculator Required Minimum Distributions Calculator

Rent Vs Buy Calculator Paying Off Credit Cards Free Credit Card Mortgage Payoff

How To Calculate Rmds Forbes Advisor

Employee Cost Calculator Quickbooks Quickbooks Calculator Employee

Retirement Withdrawal Calculator How Long Will Your Savings Last In Retirement Updated For 2020 Investing For Retirement Personal Finance Lessons Spending Money Wisely

Fire Calculators App Our Debt Free Lives Retirement Calculator Budget Calculator 401k Retirement Calculator

How To Roll Over Your 401 K To An Ira Smartasset Saving For Retirement How To Plan 401k Plan

Roth Ira Contribution Limits Medicare Life Health 2019 2020 Rules Roth Ira Roth Ira Contributions Ira

Required Minimum Distribution Rmd Calculator In 2022 Required Minimum Distribution Calculator Simple Ira

Safe Withdrawal Rate For Early Retirees 401k Withdrawal Retirement Calculator How To Plan

Our Retirement Calculator And Planner Estimates Monthly Retirement Income And Efficient Retirement Savings S Retirement Calculator Retirement Planner Financial

Pin On Financial Independence App